inheritance tax rate indiana

Each class is entitled to. The inheritance tax was repealed.

Indiana State Tax Guide Kiplinger

Class A Net Taxable Value of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over.

. No tax has to. 081 average effective rate. A strong estate plan starts with life.

The inheritance tax rates for each class are. The act was amended in 1915 1917and 1919. INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS IC 6-41-3 Chapter 3.

The Iowa tax only applies to inheritances resulting from estates worth more than 25000. Do not file Form IH-6 with an Indiana court having probate. Indiana repealed the inheritance tax in 2013.

Indianas statewide income tax has decreased twice. In 2020 there is an estate tax exemption of 1158 million. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property.

The state does not tax Social Security benefits. Indiana inheritance tax was eliminated as of January 1 2013. Each heir or beneficiary of a decedents estate is divided into three classes.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Overall Indiana Tax Picture.

Does Indiana Have an Inheritance Tax or Estate Tax. This means without an Indiana inheritance tax Indiana estates have to be greater than 525 million before any state or federal death taxes would be due. In Maryland the tax is only levied if the estates total value is more than 30000.

Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. Note that historical rates and tax laws may differ. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel.

It fully taxes withdrawals from retirement accounts. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021.

Indiana has a three class inheritance tax system and the exemptions and tax rates. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

Box 71 Indianapolis IN 46206-0071. The estate tax is a tax on a persons assets after death. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Indiana used to impose an inheritance tax. Inheritance tax was repealed for individuals dying after December 31 2012.

Indiana repealed the inheritance tax in 2013. So no inheritance tax returns Form IH-6 for Indiana residents for Form IH-12 for non-residents have to be prepared or filed. Indiana is moderately tax-friendly for retirees.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person.

How Tax Brackets Work 2023 Tax Brackets White Coat Investor

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Living In New Jersey May Be Bad But Dying In New Jersey Is Worse International Liberty

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

The Ethics Of Taxation Trilogy Part I Seven Pillars Institute

Where Not To Die In 2022 The Greediest Death Tax States

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Trump Proposes The Most Sweeping Tax Overhaul In Decades The New York Times

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Corporate Income Taxes Urban Institute

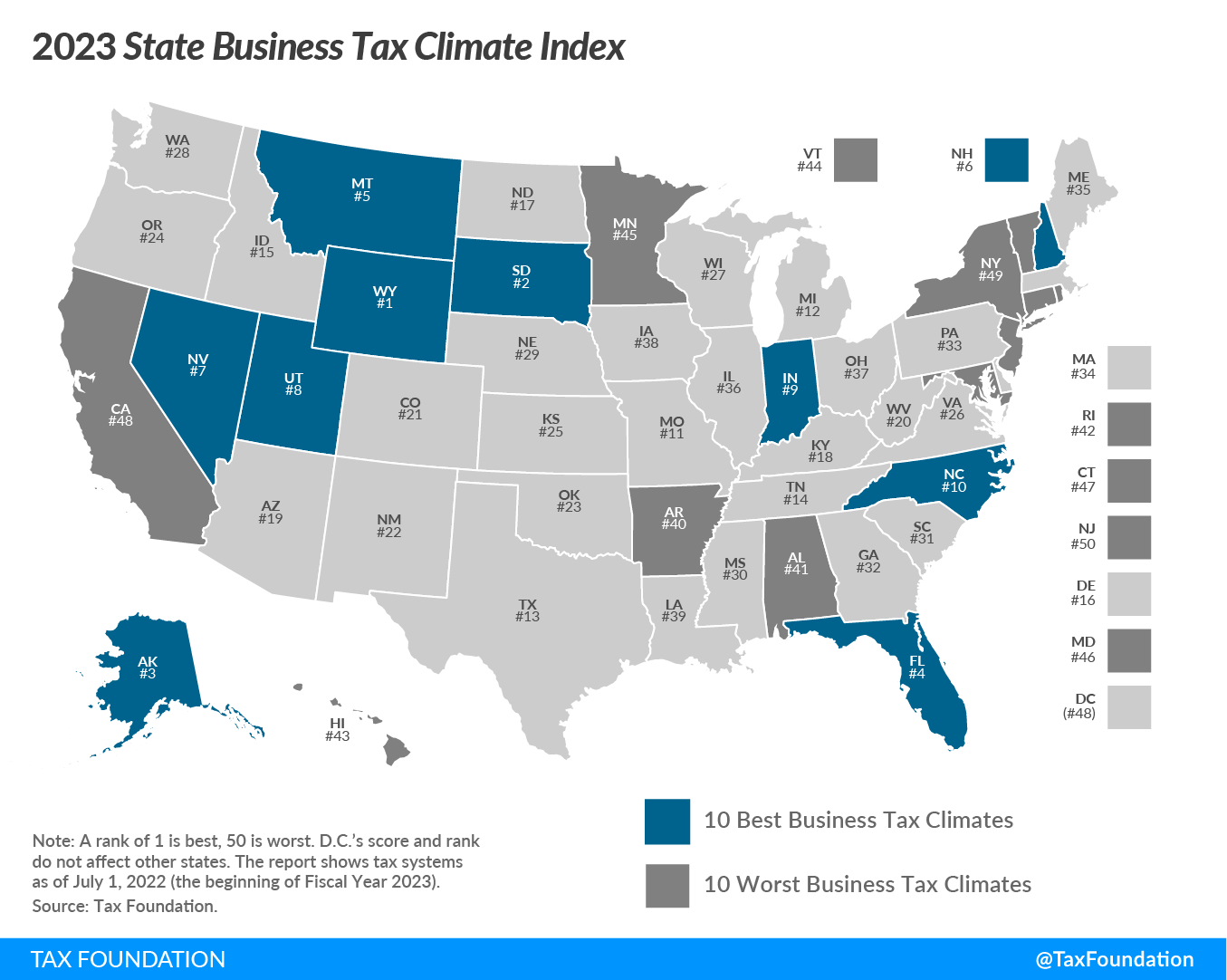

2023 State Business Tax Climate Index Tax Foundation

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Estate Tax Rates Forms For 2022 State By State Table

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation